Feb 3, 2023The average tax refund was $3,252 in 2022, up 15.5% from the year before, according to the latest filing statistics data from the IRS that runs through Dec. 30. The average refund was $2,816 in

Why is my tax return so low this year? : r/AusFinance

Dec 2, 2022Why your 2023 tax refund might be smaller than 2022’s. The average income tax refund jumped to $3,253 in 2022, up from $2,863 the previous year. The IRS is taking extra measures to ensure against

Source Image: financialpost.com

Download Image

Jan 31, 2023Economic impact payments, an increased child tax credit and expanded eligibility for other tax breaks helped boost the average refund to $3,039 in 2022, a 7.5% increase from the year before.

Source Image: reddit.com

Download Image

Exclusive: Reddit in AI content licensing deal with Google | Reuters Jan 27, 2023January 27, 2023 11:07 AM EST. M any Americans will be getting a smaller tax refund this year as the tax credits offered as pandemic relief have reverted back to pre-pandemic levels, the Internal

Source Image: reddit.com

Download Image

Why Is My Tax Return So Low 2023 Reddit

Jan 27, 2023January 27, 2023 11:07 AM EST. M any Americans will be getting a smaller tax refund this year as the tax credits offered as pandemic relief have reverted back to pre-pandemic levels, the Internal Jan 29, 2023Check Your Tax Return For Accuracy. If your refund is smaller than you thought it would be and you believe the change isn’t the result of anything outlined by the IRS, the first thing you should

Why is my return so low : r/IRS

Some info: 2022’s return: Married filed jointly. 3 dependents (children) claimed – $6k in child tax credit. About $50k in wages from work. About $100k income from investments (crypto). No income from spouse. At the end I owed the IRS shy of $6k. 2023 return: Married filing jointly. 4 dependents (children) to be claimed – $8k in child tax Reddit files to list IPO on NYSE under the ticker RDDT

Source Image: cnbc.com

Download Image

Reddit Stock Surges in IPO | Morningstar Some info: 2022’s return: Married filed jointly. 3 dependents (children) claimed – $6k in child tax credit. About $50k in wages from work. About $100k income from investments (crypto). No income from spouse. At the end I owed the IRS shy of $6k. 2023 return: Married filing jointly. 4 dependents (children) to be claimed – $8k in child tax

Source Image: morningstar.co.uk

Download Image

Why is my tax return so low this year? : r/AusFinance Feb 3, 2023The average tax refund was $3,252 in 2022, up 15.5% from the year before, according to the latest filing statistics data from the IRS that runs through Dec. 30. The average refund was $2,816 in

Source Image: reddit.com

Download Image

Exclusive: Reddit in AI content licensing deal with Google | Reuters Jan 31, 2023Economic impact payments, an increased child tax credit and expanded eligibility for other tax breaks helped boost the average refund to $3,039 in 2022, a 7.5% increase from the year before.

Source Image: reuters.com

Download Image

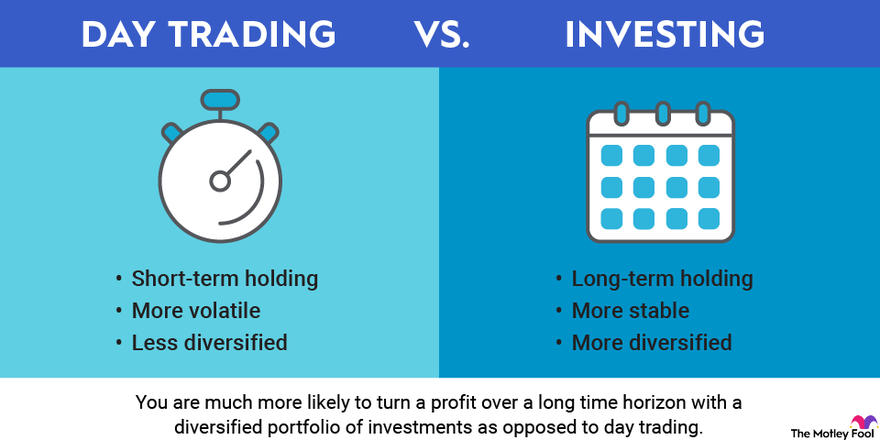

Day Trading: What It Is & Why It’s a Bad Idea | The Motley Fool Apr 3, 2023The total amount refunded to taxpayers by the Internal Revenue Service to date this year is approximately $172 billion — $16.4 billion less than in in 2022, the latest data from the agency shows

Source Image: fool.com

Download Image

Pinterest sees stronger margins as ad rebound boosts quarterly results | Reuters Jan 27, 2023January 27, 2023 11:07 AM EST. M any Americans will be getting a smaller tax refund this year as the tax credits offered as pandemic relief have reverted back to pre-pandemic levels, the Internal

Source Image: reuters.com

Download Image

Reddit files for IPO. Here’s why US consumers should invest in it – Hindustan Times Jan 29, 2023Check Your Tax Return For Accuracy. If your refund is smaller than you thought it would be and you believe the change isn’t the result of anything outlined by the IRS, the first thing you should

Source Image: hindustantimes.com

Download Image

Reddit Stock Surges in IPO | Morningstar

Reddit files for IPO. Here’s why US consumers should invest in it – Hindustan Times Dec 2, 2022Why your 2023 tax refund might be smaller than 2022’s. The average income tax refund jumped to $3,253 in 2022, up from $2,863 the previous year. The IRS is taking extra measures to ensure against

Exclusive: Reddit in AI content licensing deal with Google | Reuters Pinterest sees stronger margins as ad rebound boosts quarterly results | Reuters Apr 3, 2023The total amount refunded to taxpayers by the Internal Revenue Service to date this year is approximately $172 billion — $16.4 billion less than in in 2022, the latest data from the agency shows